Electronic Visit Verification (EVV) – Smartcare eVerified

Across the Nation, Smartcare is helping agencies stay EVV compliant, empower caregivers and improve workflow.

Electronic Visit Verification (EVV)

Smartcare’s EVV platform ensures the right care is delivered at the right time. Using Smartcare’s intelligent EVV service, Smartcare eVerified, your agency can verify your caregiver’s mobile workflow, ensure compliance, track total care, and improve outcomes.

Smartcare’s intelligent EVV tools and Smartcare eVerified keep patients and caregivers safe from fraud and provide agencies with the leading digital solution for staying compliant and running a successful home care business.

What is EVV?

Electronic Visit Verification (EVV) is a method used to verify home healthcare visits to ensure patients are not neglected and to cut down on fraudulently documented home visits. EVV is required by most states for State Medicaid providers as part of the 21st Century Cures Act.

Accuracy Made Simple

Smartcare offers compliant EVV for home care providers in the US. Our EVV multi-technologies, including GPS, mobile phone, and telephony, ensure providers get the right solution for them.

EVV ensures service delivery by electronically capturing:

- Date of the visit

- Clock in time and location

- Clock-out time and location

- A client who received the service

- Caregiver who provided the services

- Service that was delivered

This information is captured by Smartcare and sent to the state-selected aggregator for review. Check out our state-by-state EVV database below to see how Smartcare works with your state’s Medicaid EVV requirements.

Complete Platform with EVV

As part of our complete home care platform, Smartcare’s mobile app supports Medicaid and other payer requirements for managing home care agencies’ EVV and eBilling needs.

Ensuring Accuracy & Compliance

Using multiple technologies, Smartcare ensures EVV accuracy and compliance. Caregivers can easily and quickly clock in/out and capture state-specific essential EVV information. Smartcare’s eVerified engine handles the rest.

Automated Documentation & Transmission

Smartcare automatically records the necessary tracking information and directly transmits this to the state or approved aggregator.

Why Smartcare?

Smartcare’s eVerified EVV is designed and built to be a fully compliant EVV solution. Intuitive and easy to use, Smartcare EVV is used across the US by caregivers every day.

Smartcare’s EVV experts assist with:

- One-on-one specialized training to configure caregivers, clients, and visits correctly for submission

- Integration with state-selected aggregator to transmit data

- EVV Management and KPIs, designed to simplify and streamline the submission process and reduce exception reasons that could result in payment delays or sanctions

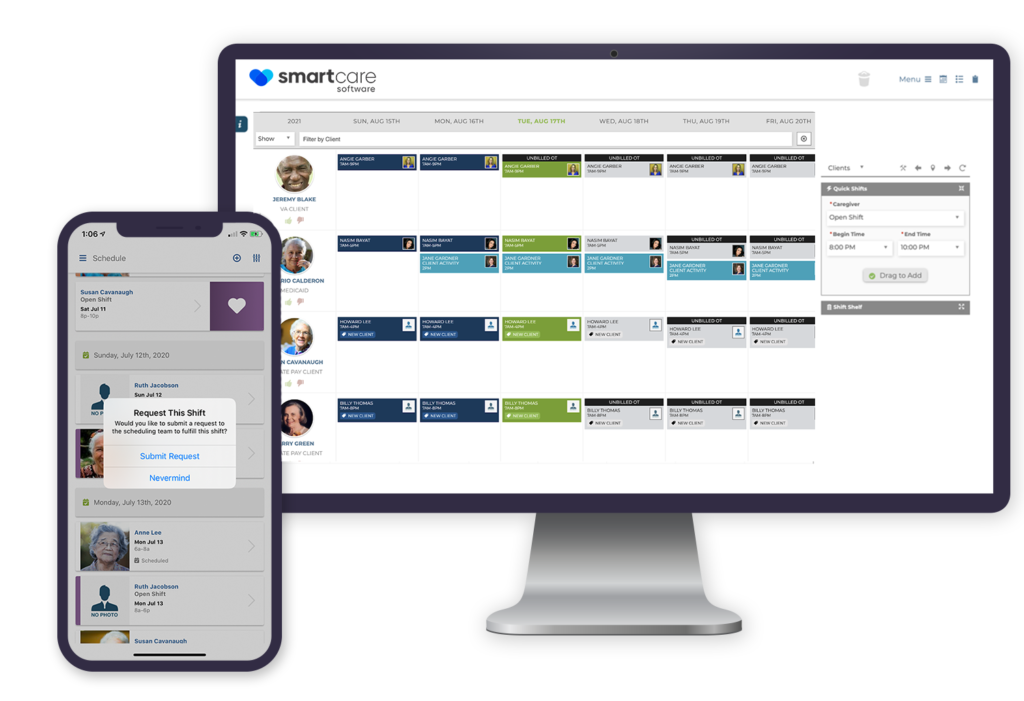

Smartcare eVerified EVV & Mobile App

Smartcare’s eVerified is the complete EVV solution customized for your requirements. Smartcare’s mobile app includes:

All from the Smartcare Mobile App with EVV — it’s that easy!

Meeting State EVV requirements

State Open EVVSmartcare’s eVerified EVV solution is a great fit for home care agencies in states with an Open model State EVV. The Smartcare advanced EVV technology and platform exceeds the federal EVV requirements today.

State Closed EVVState-assigned, specific EVV vendors and aggregators – Let’s talk, we can help!

Some states have chosen to mandate a specific vendor for providing the EVV component for the Medicaid client base. Smartcare has already built integrations with many of the most widely used EVV State vendors including Sandata, Tellus, HHAeXchange, and others.

Check out our state-by-state EVV database below to see how Smartcare works with your state’s Medicaid EVV solution requirements.